AIF

What is AIF ?

Alternative Investment Funds (AIFs) are investment vehicles established in India that pool

funds from sophisticated investors, both Indian and foreign, for investing in accordance with

a defined investment policy. AIFs encompass a variety of investments outside the traditional

asset classes of stocks, bonds, and cash, including private equity, hedge funds, venture

capital, real estate, and other structured investment products. Alternative Investment Funds

(AIFs) represent a dynamic and growing segment of the Indian financial market, offering

investors opportunities to diversify their portfolios and achieve potentially higher returns.

Governed by SEBI regulations, AIFs ensure transparency, professional management, and a

structured investment approach, making them an attractive option for sophisticated investors

willing to navigate the associated risks.

Categories of AIF

Category I

- Venture Capital

- Infrastructure Fund

- Angel Fund

- Social Venture Fund

Category II

- Private Equity Fund

- Real Estate Funds

- Funds for Distressed Assets

Category III

- Hedge Funds

- Private Investment in Public Equity Fund

Fund Snapshot

Year of Inception

February 2024

Fund Type

Close Ended Category II AIF

Fund Size

200 Cr with Green Shoe Option of 200 Cr

Minimum Investment

1 Cr

Number of Investments

20-25 (Proposed)

Investment Horizon

3-5 Years

Fund Snapshot

Year of Inception

February 2024

Fund Type

Close Ended Category II AIF

Fund Size

200 Cr with Green Shoe Option of 200 Cr

Minimum Investment

1 Cr

Number of Investments

20-25 (Proposed)

Investment Horizon

3-5 Years

Why Stressed Asset AIF ?

- Greater flexibility and scope in relation to other investment options, hence lesser chance of diminishing value

- Better returns (with relatively lower risk). Investments in Start-up funds have suffered losses

- Better diversification, hence low correlation with other investments

- Attractive structured investment options through AIF for HNIs with better possibilities of capital appreciation (as the equity markets are richly valued)

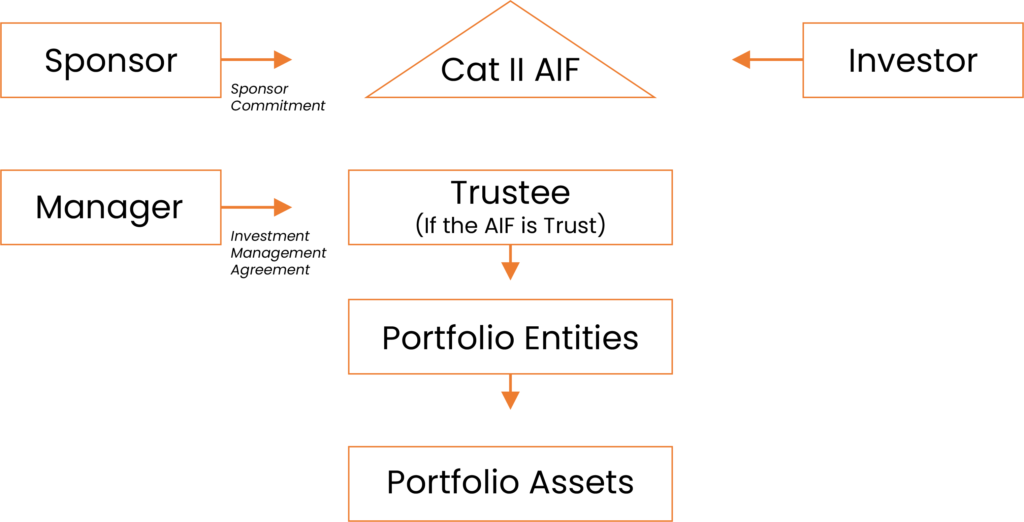

Structure of AIF

Grievances and Complaints

HEAD OFFICE

- NuOm Alternative Investment Trust Shri Balaji, Plot no. 47, Hindusthan Colony, Wardha Road, Nagpur - 440015

- +91 9890426336

- nuomaif@gmail.com